How to File Property Mutation in Haryana — A Complete Step-by-Step Guide

Mutation is the official entry made in the Jamabandi (Record of Rights) that a property has changed hands. After mutation, the State’s databases, tax ledgers and utility departments all show the new owner.

Not the same as registration – Registration under the Indian Registration Act finalises the deed between buyer and seller, but mutation tells the revenue department who must pay taxes and who can legally deal with the land later.

Legal weight – Section 44 of the Punjab Land Revenue Act, 1887 (still applicable in Haryana) gives presumption of correctness to Jamabandi entries, so a fresh mutation helps you avoid future disputes.

Situations in which you must apply

Trigger event | Examples | Recommended deadline |

Sale or gift | Sale deed, gift deed | Immediately after registration |

Inheritance | Death of owner, succession certificate, will | Within 6 months of death |

Partition/ court decree | Family partition, civil court order | Within 3 months of order |

Government allotment | HUDA/HSVP transfer, rehabilitation allotment | On receipt of allotment letter |

Flat owners can apply a little later, but landholders should file right away to keep their title chain clear.

Laws and Service-Level Guarantees

Haryana Right-to-Service Act, 2014 prescribes a 30-day limit for “attestation of uncontested mutation.”

Haryana Land Revenue (Amendment) Act, 2025 has digitised many revenue functions, making online filing valid evidence.

If officials miss the 30-day deadline, you can complain to the District RTS Commission. Penalties can be imposed on the Tehsildar.

Documents you Will Need

Application Form VII (auto-generated online or paper form from Tehsil)

Proof of title transfer – sale deed / gift deed / will / court decree

Jamabandi (last copy) or mutation order of previous entry

Identity proof of applicant (Aadhaar, PAN, voter card)

Affidavit & indemnity bond (format supplied by Tehsil) – only if asked

Death certificate (for inheritance cases)

No-objection certificate from co-owners (for gift or partition)

Latest property-tax receipt (urban holdings)

Keep scanned PDFs (100 dpi, ≤2 MB each) ready if you opt for the online route.

Fee Structure in 2025

Particular | Amount |

Mutation entry fee (acquisition, sale, gift, etc.) | ₹ 250 |

Digital Integration & Treasury Service (DITS) charge | ₹ 50 |

Affidavit stamping (if required) | ₹ 10–₹ 100 |

Certified copy of mutation order | ₹ 20 (per page) |

Total cost for a straightforward sale mutation is usually ₹ 300, excluding any affidavit or notary costs.

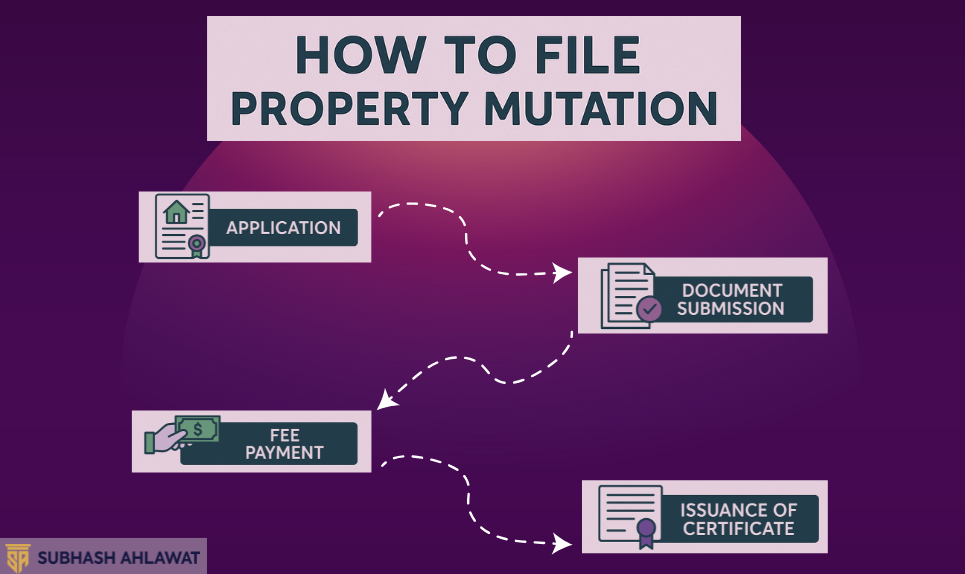

Online Method (Jamabandi Portal) – Step by Step

Create a login – Go to jamabandi.nic.in → Register as Citizen. Fill in the mobile OTP and choose the password.

Start a new application – Dashboard → Mutation Based on Deed. Select Sale/Gift/Inheritance/Other.

Enter property details – District, Tehsil, Village/Urban Ward, Khewat & Khasra or Property ID.

Upload deed PDF – The portal auto-pulls key fields from the registered deed using HARIS data.

Attach supporting files – Death certificate, affidavit, NOC as applicable.

Auto-calculate fee – System shows ₹ 250 + ₹ 50. Pay via e-GRAS net-banking, UPI or credit card.

Submit & receive receipt – Receipt carries a Mutation Request Number (MRN) and expected hearing date.

Track status – Services → Check Mutation Status; enter district, tehsil, deed number.

Verification – Patwari visits the site if needed, tallies boundaries, and writes a Report.

Public notice – System posts a seven-day objection period on the portal and at the village noticeboard.

Circle Revenue Officer (CRO) order – If no objection, CRO digitally signs Dakhil-Kharij order.

Download mutation certificate – Available under My Applications → Download.

Average completion time: 5–30 days depending on field verification workload.

Offline Method (Tehsil / CSC)

Collect Form VII at the Mutation Counter or Atal Seva Kendra.

Fill in blue or black ink – Use BLOCK letters, don’t leave blanks.

Attach photocopies of sale deed, jamabandi, ID proof, etc., and self-attest each page.

Affix court-fee stamp of ₹ 250 and treasury receipt of ₹ 50 to the form (cash counter in Tehsil).

Submit to Patwari/kanungo – Get Diary Number on your copy.

Spot-visit & report – Patwari checks physical boundaries and obtains neighbour signatures.

Notice period – 7 days for objections; objections recorded in red ink in Roznamcha.

Attestation by CRO – Uncontested cases are signed off in a standing Camp held weekly.

Collect certified copy – Visit Record Room, pay ₹ 20 to get a stamped copy.

Tip: Keep SMS alerts ON during filing; many Tehsils send stage-wise SMS under the 2025 digital-hybrid workflow.

How the Verification Works

Patwari’s field book – Patwari plots existing boundaries, compares khasra numbers and notes any encroachment.

Kanungo cross-checks – He ensures measurements follow the map in the Mussavi records.

CRO hearing – If any heir or neighbour objects, CRO records statements and may order demarcation.

Final order – Signed mutation number is entered in Jamabandi; the previous owner’s column gets “dakhal-karij”.

Need extra help? – For smoother handling and fewer delays, you can also approach an Advocate Subhash Ahlawat who knows this process well and can guide you through objections or paperwork.

This layered process keeps revenue data accurate and reduces title fraud.

Timelines and Escalation

Stage | Normal time | Escalate to |

Receipt to field report | 7 days | Naib-Tehsildar |

Notice period | 7 days | – |

CRO decision | 16 days | Sub-Divisional Magistrate |

Total (uncontested) | 30 days | District RTS Commissioner |

If 30 days pass with no result, file Form B under the RTS Act at the same Tehsil; copy to Deputy Commissioner.

Dealing with Objections or Rejection

Common grounds – Wrong Khasra number, unpaid stamp duty on deed, rival heir’s claim, or map mismatch.

Fixing issues – Supply missing papers, pay deficit duty via e-stamp & GRAS, or file consent affidavit from heirs.

Re-apply – There is no extra fee if you re-submit within 30 days of rejection; attach the rejection memo.

Appeal – Against an adverse CRO order, appeal to SDM within 30 days, then to Divisional Commissioner.

Tracking and Obtaining Certified Copies

Online – Enter district, tehsil, deed date in, check Mutation Status to see “Accepted / Pending / Rejected.”

SMS & e-mail – The portal emails the signed PDF automatically once approved.

Tehsil counter – Quote Mutation Number; pay ₹ 20 and obtain a revenue-stamped copy good for banks and courts.

Practical Tips to Avoid Delays

Spellings must match – Names in Aadhaar, deed and application should be identical.

Upload legible scans – Blurry sale deeds trigger “document illegible” rejection notices.

Follow up after a week – A polite reminder call to the Patwari often speeds up the site visit.

Pay property tax immediately after mutation; the urban civic body sometimes insists on mutation copy first.

Keep old mutation copies – Banks often seek the last two mutation numbers for loan sanction.

Frequently Asked Questions

Q 1. Is mutation compulsory for flats in a housing society?

Yes, if the flat falls under the municipal limits and property tax is levied individually. Societies sometimes bulk-pay tax, but mutation still helps when you sell later.

Q 2. Can I sell before mutation is done?

Legally possible (the sale deed is enough), but buyers and banks insist on the latest mutation, so the deal may fall through.

Q 3. Is an e-stamp for ₹ 250 enough?

Yes. Haryana fixed a flat mutation entry fee of ₹ 250 plus ₹ 50 service charge regardless of property value.

Q 4. Does mutation give a conclusive title?

No, it is an administrative record, but courts treat recent uncontested mutations as strong evidence of possession.

Q 5. How long is a mutation certificate valid?

Until the next change of ownership or land-use category—there is no expiry date.

Conclusion

Filing a property mutation in Faridabad, Haryana has become mostly digital and citizen-friendly. By gathering the right documents, paying the modest ₹ 300 fee online, and keeping track of your Mutation Request Number, you can usually get the certificate within a month. If officials delay or reject without good reason, the Haryana Right-to-Service framework lets you escalate quickly. Completing this single but critical step protects your ownership, keeps property taxes up to date and paves the way for smooth future transactions. Follow the detailed checklist above, and you can finish the mutation with minimal stress and zero middlemen.